Wall Street, Europe, and Asia post solid gains after Washington and Beijing agree to temporarily lower tariffs, lifting investor sentiment worldwide.

Global financial markets surged on Monday following the announcement of a temporary trade truce between the United States and China. The world’s two largest economies agreed to reduce key tariffs for 90 days, triggering strong gains across equities, currencies, and digital assets.

Under the new agreement, the U.S. will lower tariffs on Chinese imports from 145% to 30%, while China will cut duties on American goods from 125% to 10%. The move is seen as a strategic pause to ease tensions and create space for renewed trade talks after years of economic friction.

Wall Street leads the rebound

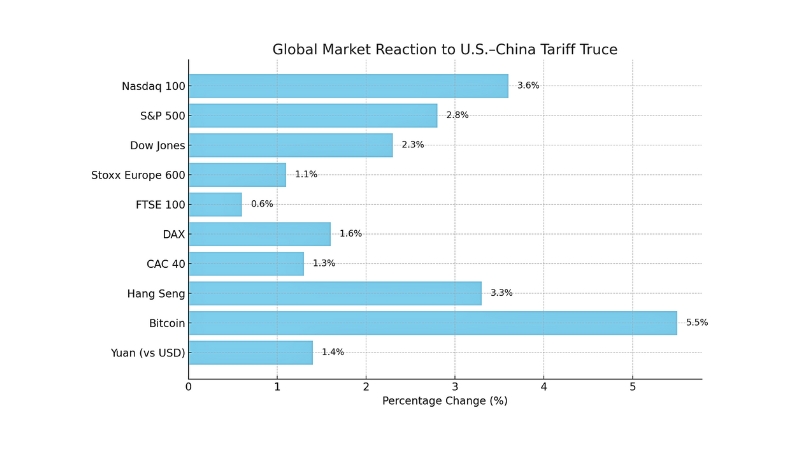

Futures for major U.S. indices soared on the news. The Nasdaq 100 jumped 3.6%, its biggest gain in weeks. The S&P 500 advanced 2.8%, while the Dow Jones climbed 2.3%. Traders are betting that the easing of trade barriers will boost corporate earnings and reduce uncertainty, particularly in technology and industrial sectors.

European markets follow with strong gains

Across the Atlantic, investors also welcomed the development. The Stoxx Europe 600 rose 1.1% in early trading, buoyed by optimism over global trade. National benchmarks posted robust increases: London’s FTSE 100 edged up 0.6%, Germany’s DAX surged 1.6%, and France’s CAC 40 gained 1.3%.

Asian markets respond enthusiastically

Asian exchanges closed higher, led by Hong Kong’s Hang Seng Index, which rallied more than 760 points—approximately a 3.3% jump. The region, heavily reliant on global trade flows, stands to benefit from any thawing of U.S.–China relations.

Yuan strengthens, bitcoin hits new record

In the currency markets, China’s yuan appreciated to 7.2 per U.S. dollar, marking its strongest level since November 2024. Analysts cited renewed confidence in China’s economic prospects and a potential easing of capital outflows.

Meanwhile, the cryptocurrency sector saw significant movement. Bitcoin surged past the $105,000 mark, a new all-time high. Investors appear to be seeking alternative assets amid global policy shifts and hopes for improved liquidity conditions.

Short-term optimism, long-term questions

While the market reaction has been overwhelmingly positive, economists warn that the agreement is only a temporary fix. “This truce is a welcome development, but it’s not a resolution,” said Jennifer Marks, a senior analyst at Capital Insights. “The real test will be whether both sides can use this window to craft a sustainable trade framework.”

With U.S. elections approaching and geopolitical pressures mounting, the coming weeks will be pivotal. For now, however, global investors are embracing a rare dose of good news—and markets are responding accordingly.