With over 2 million vacant homes and skyrocketing interest rates, Florida’s real estate shows signs of distress as homeowners panic and buyers vanish

Florida, once a sizzling hot real estate haven, is now grappling with a stunning reversal in fortune. More than 2 million homes currently sit vacant across the state, sparking alarm among economists, investors, and homeowners alike. The question on everyone’s mind is clear: Is the Florida housing market crashing?

A Crisis of Confidence

Just two years ago, Florida’s housing market was booming. Migration from other states, a hot vacation rental market, and historically low interest rates kept demand sky-high. Today, the narrative has flipped. Homes are staying on the market for months, prices are stagnating or falling in key regions like Miami-Dade, Orlando, and Tampa, and prospective buyers are increasingly scarce.

According to recent data from the Florida Department of Economic Opportunity and real estate analytics firm CoreLogic, buyer activity has dropped nearly 38% year-over-year, the sharpest decline since the 2008 financial crisis.

Why No One Wants to Buy

One of the primary culprits is the sharp increase in mortgage interest rates, which now hover near 7.25% for a 30-year fixed loan, up from just under 3% in early 2022. For many would-be homeowners, the jump translates into hundreds or even thousands of extra dollars in monthly payments—pricing them out of the market entirely.

“Buyers have hit the brakes,” says Sandra Delgado, a senior broker in Fort Lauderdale. “Many are choosing to rent or wait it out. They just don’t want to take on that kind of financial burden right now.”

Compounding the issue, rental prices have plateaued or dropped slightly, offering little incentive to make long-term purchases. Investor interest, particularly from out-of-state and international buyers, has also waned amid economic uncertainty and diminishing returns in the short-term rental market.

Homeowners Begin to Panic

As properties linger unsold, homeowners are beginning to panic—especially those who purchased recently or refinanced at low rates and are now struggling with rising insurance premiums, HOA fees, and property taxes.

Florida’s unique exposure to climate risk is also contributing to the crisis. With hurricane seasons intensifying and insurance companies either raising rates sharply or pulling out of the market altogether, the cost of homeownership is becoming unsustainable for many.

“I love my house, but we just can’t afford to stay here,” said Mark H., a 52-year-old Tampa resident who recently put his home on the market. “Our insurance tripled this year. It’s not just interest rates—it’s everything.”

The Mass Exodus

The state is also experiencing a notable population outflow, reversing the COVID-era trend that saw droves of Americans relocating to Florida for its weather, tax advantages, and looser restrictions.

Now, residents are leaving due to rising living costs, overdevelopment, traffic congestion, and a faltering infrastructure system. Many are heading back north or exploring more affordable southern states like Georgia, Alabama, and the Carolinas.

What to Expect Next?

Analysts are cautious in their predictions. While some stop short of calling it a full-blown crash, most agree that Florida’s housing market is entering a period of sustained correction.

“If rates remain high through the rest of the year, and vacancies continue to mount, we could see a 10–15% drop in home values in some overbuilt areas,” says Joel Myers, a real estate economist with CapitalEdge. “That’s going to put more pressure on already-struggling homeowners.”

Others, however, see a silver lining for patient buyers. “We’re likely to hit a tipping point where prices adjust, and opportunities emerge for buyers who were previously priced out,” said Myers. “But that may not happen until 2026 or later.”

Final Thoughts

Whether Florida is on the verge of a crash or just a deep market correction remains to be seen. What is clear is that the state’s housing market, once seemingly invincible, is now under serious stress—and the ripple effects could impact the broader U.S. economy if conditions don’t stabilize soon.

As millions of homes remain empty and fear grips homeowners, Florida is entering a new and uncertain chapter in its real estate history.

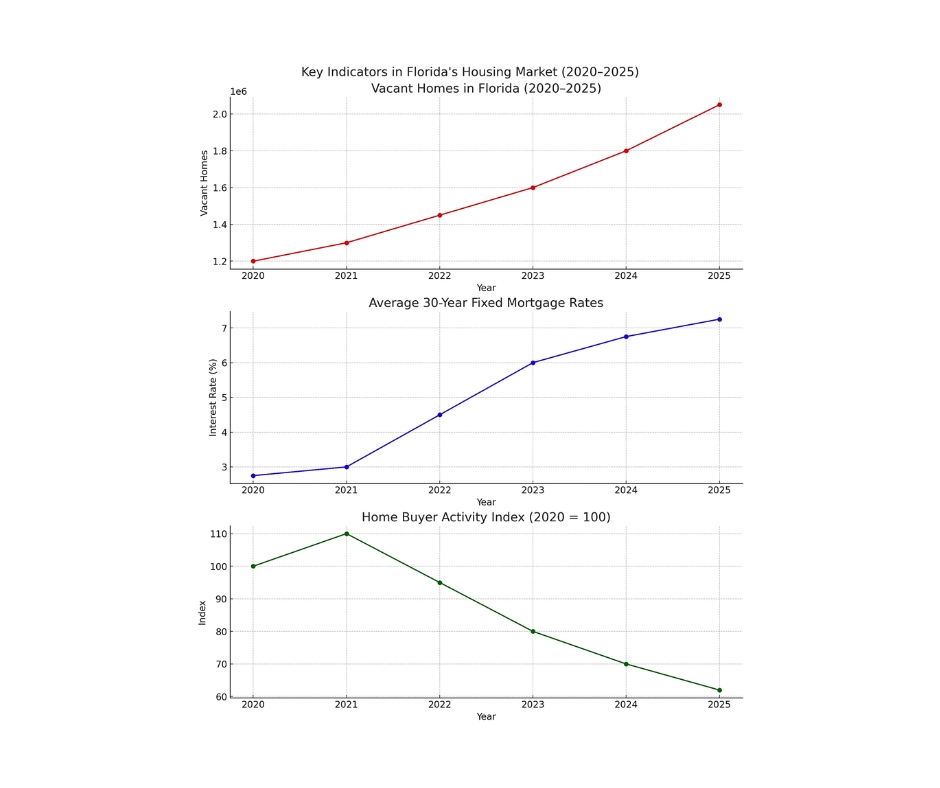

Florida’s housing market trends from 2020 to 2025:

-

- Vacant Homes – A sharp increase to over 2 million properties.

- Interest Rates – Climbing steadily to over 7%.

- Buyer Activity Index – A significant decline, reflecting market hesitation.